As of April 1st, 2025, significant changes to stamp duty rates across England and Wales will come into effect. We're here to explain what these changes mean for you, whether you're a first timer, an investor, or moving from overseas.

New stamp duty rates

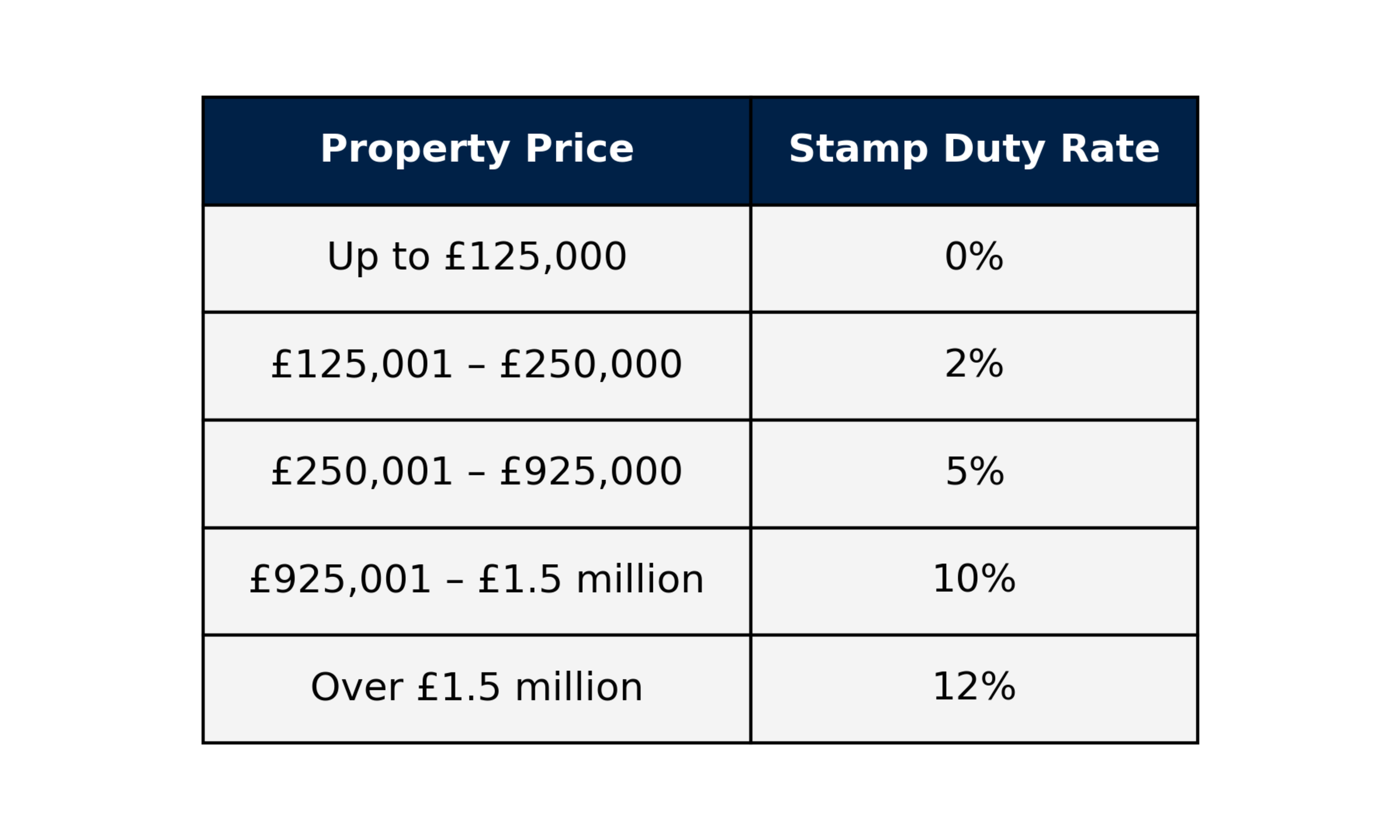

The stamp duty structure has been modified, affecting how much tax is payable based on a property's purchase price. Here's a simple table to show you the new rates:

UK Stamp Duty Land Tax Rates from 1st April 2025

Let’s do the math

In April 2025 you buy a house for £350,000. The Stamp Duty you owe will be calculated as follows:

0% on the first £125,000 = £0

2% on the second £125,000 = £2,500

5% on the final £100,000 = £5,000

Total Stamp Duty: £0 + £2,500 + £5,00 = £5,000

First-time buyers: What's changed?

If you're buying your first home, the rules have tightened:

Up to March 31 , 2025: No stamp duty on properties up to £425,000; 5% on the portion from £425,001 to £625,000.

From April 1, 2025: No stamp duty on properties up to £300,000; 5% on the portion from £300,001 to £500,000.

A first-time buyer purchasing a property at £500,000 now faces:

0% on the first £300,000: £0

5% on the remaining £200,000: £10,000

London's high prices make this a real hurdle for first-time buyers. Extra costs mean careful planning is needed.

Investors and second homes

Got a buy-to-let or a second home? The stamp duty rate has gone up:

Second property UK Stamp Duty rates from 1 April, 2025

Example: Purchasing an additional property at £500,000 now incurs:

5% on the first £125,000 = £6,250

7% on the next £125,000 = £8,750

10% on the remaining £250,000 = £25,000

Total Stamp Duty: £6,250 + £8,750 = £40,000

Non-UK Residents

If you're buying from outside the UK, you'll still pay an extra 2% on top of everything else.

What you can do (and how we can help)

Navigating these stamp duty changes requires careful planning, especially for first-time buyers and investors. Don't let these adjustments derail your property goals. We're here to help you understand the impact and find the right mortgage strategy.

Crunch the numbers

Calculate the new stamp duty liability based on the updated rates to understand the total cost of purchasing a property.

Talk to Tony

As independent mortgage consultants, we can help you find mortgage options to ease the burden.

Explore stamp duty relief

From 1 April 2025, Stamp Duty relief will only be available to first-time buyers purchasing a property worth £500,000 or less.

Ready to discuss your options?

Let’s talk. Book a no-obligation online mortgage meeting with our award winning independent mortgage consultant, Tony.

Your home (or property) may be repossessed if you do not keep up repayments on your mortgage or any other debts secured on it. A fee may be charged for mortgage advice. The amount will depend on your circumstances.

Skyline Mortgage Consultants Limited is an Appointed Representative of The Right Mortgage Ltd, which is authorised and regulated by the Financial Conduct Authority. Skyline Mortgage Consultants LTD is registered in England and Wales Number 8157062. Company Registered Office: Suite130, 394 Muswell Hill Broadway Muswell Hill London N10 1DJ.